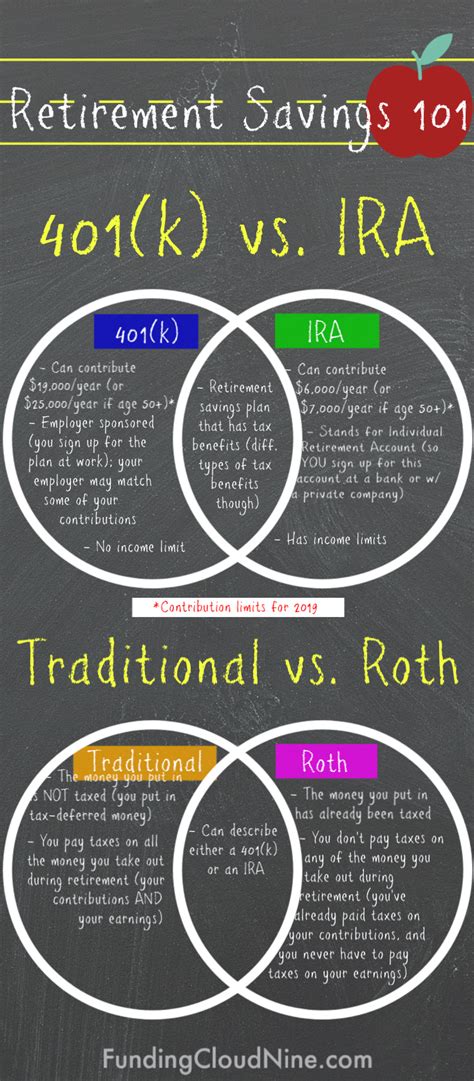

401K VS 2025: The Retirement Savings Showdown

Introduction

Saving for retirement is essential for financial security. However, with so many options available, it can be challenging to decide the best one. Two popular choices are the 401(k) and the 2025 plan. This article compares the two plans to help you make an informed decision.

401(k) Plans: A Traditional Retirement Option

- Contributions: 401(k) plans allow employees to contribute a portion of their pre-tax income.

- Employer Matching: Many employers offer matching contributions, which can significantly boost savings.

- Tax Benefits: Contributions and earnings grow tax-deferred until withdrawn in retirement.

- Investment Options: 401(k) plans offer a wide range of investment options, including stocks, bonds, and mutual funds.

2025 Plans: A Newer Retirement Vehicle

- Contributions: 2025 plans allow employees to contribute after-tax dollars.

- Tax Benefits: Contributions are not tax-deductible, but earnings grow tax-free until withdrawn in retirement.

- Investment Options: 2025 plans offer a limited range of investment options, typically mutual funds.

- Required Minimum Distributions (RMDs): Unlike 401(k) plans, 2025 plans do not have RMDs, providing more flexibility in retirement.

Comparing 401(k) and 2025 Plans

| Feature | 401(k) Plan | 2025 Plan |

|---|---|---|

| Contribution Timing | Pre-tax | After-tax |

| Tax Benefits | Tax-deferred growth | Tax-free growth |

| Investment Options | Wide range | Limited range |

| Employer Matching | Common | Not typically available |

| RMDs | Required | Not required |

Which Plan is Right for You?

The best retirement plan depends on your individual circumstances. Here are some factors to consider:

- Income Level: 401(k) plans offer tax deductions that can be more beneficial to higher-income earners.

- Employer Matching: If your employer offers matching contributions, a 401(k) plan may be the more advantageous option.

- Investment Goals: 401(k) plans offer more investment flexibility, so they may be suitable for those with specific investment goals.

- Retirement Age: 2025 plans offer more flexibility in retirement, so they may be a better option if you plan to retire early or withdraw funds without penalty.

Tips for Maximizing Retirement Savings

- Contribute Early and Regularly: The sooner you start saving, the more time your money has to grow.

- Take Advantage of Employer Matching: If available, maximize your employer’s matching contributions to boost your savings.

- Choose the Right Investments: Diversify your portfolio by investing in a mix of stocks, bonds, and mutual funds.

- Rebalance Regularly: Periodically adjust your asset allocation to maintain your desired risk tolerance.

- Consider a Roth Option: Roth 401(k) and Roth 2025 plans offer tax-free withdrawals in retirement, which can be beneficial for those in lower tax brackets.

Conclusion

401(k) and 2025 plans are both valuable retirement savings vehicles. The best choice depends on your individual circumstances and financial goals. By carefully considering the factors discussed in this article, you can make an informed decision that will help you achieve financial security in retirement.